taxing unrealized gains janet yellen

For the first time in the history of ever President Biden and Secretary Yellen want to tax unrealized gains on inherited property. Unrealized capital gains put simply is the increase in the value of an asset that has yet to be sold.

Janet Yellen S Idea To Tax Unrealized Capital Gains R Wallstreetbets

Yellen said lawmakers are considering a billionaires tax to help pay for Bidens social safety net and climate change bill.

. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. Instead of paying taxes when you finally sell your home or cash out your 401k or trade stock you would be taxed on the subjective made-up unrealized value gain right now. This has never been done before.

Do you think theres a chance this actually happens. Treasury Secretary nominee Janet Yellen reportedly said she would consider taxing unrealized capital gains but billionaire investor Howard Marks said its not a practical plan and could hurt. Lets suppose youve got a young widow with three children.

This proposal would allow the IRS to tax the gains of real estate stocks or other assetsbefore the holder decides to cash out. The plan will be included in the Democrats US 2 trillion reconciliation bill. To pay for the 5 trillion love letter to progressives the Democrats have floated taxing unrealized capital gains.

According to Yellen the funds collected would help finance things. Secretary of the Treasury Janet Yellen explaining her taxation proposal Just give me and Joe all your money. Washington DC provides stiff competition when it comes to stupid ideas related to policy spending and taxation as regular fare but the idea to tax unrealized capital gains is a real doozie.

It doesnt take a genius to realize how stupid this is and how difficult it would be to actually implement. Capital gains tax is a tax on the profit that investors realize on the sale of their assets. Lawmakers are considering taxing unrealized capital gains.

It is the theoretical profit existent on paper. For example perhaps you purchased a house at 300000 and sold it for 350000. President Biden Unveils Unrealized Capital Gains Tax for Billionaires Posted on 10252021 As US.

Janet Yellen doesnt care. Be sure to like and subscribe and hit the bell button for channel alertsSend Fan Mail with USPS ToCOMMANDER VLOGSPO BOX 643EAST OLYMPIA WA 98540Send Fan. This proposal suggests that we should be taxing unrealized capital gains as income.

WASHINGTONA new annual tax on billionaires unrealized capital gains is likely to be included to help pay for the vast social policy and climate package lawmakers hope to finalize this week. If so this would be a major hit to anyone who invests and tries to preserve wealth. Senior Democrats confirmed that a proposal to tax billionaires unrealized capital gains will likely be included in President Bidens 2.

President Biden needs to raise money for his administrations goals and United States Secretary of the Treasury Janet Yellen has an idea. The weeks best and worst from Kim. And if you dont pony up for Janet Yellens salary the government is coming for you.

If you still owned the house when it was valued at 350000 as opposed to selling it you would have grossed. Their last fiscal resort is taxing unrealized capital gains of billionaires Journal Editorial Report. She goes and buys a 150000 home to raise her kids and she raises her kids in the home.

The 78th United States secretary of the treasury Janet Yellen told CNNs State of the Union on Sunday that US. Idea Of Taxing Unrealized Gains Resurfaces As Money Printing Intensifies United States President Joe Bidens Treasury secretary nominee Janet Yellen has once again become a topic of discussion in the Cryptoverse - this time over her comments suggesting she may look to tax of unrealized gains. She raised the eyebrows of some senators and Wall Street when she said that the Treasury would consider the possibility of taxing unrealized capital gains through a mark-to-market mechanism as well as other approaches to boost revenues.

That sounds good until you realize that 100000 increase was an unrealized gain. Apparently Janet Yellen has been floating the idea of an unrealized capital gains tax. What isnt priced in is the rub of introducing new progressive tax policies.

Earlier in 2021 Yellen proposed taxing unrealized capital gains to boost US. You can trust us to be good stewards. Treasury Secretary Janet Yellen told CNNs Jake Tapper on Sunday that Senate Democrats are considering a proposal to impose a tax on unrealized capital gains of the wealthiest Americans.

Janet Yellen the Treasury Secretary in the Joe Biden administration has proposed a tax on unrealised capital gains. Treasury Secretary Janet Yellen announced on October 23 that a proposed tax on unrealized capital gains yes gains from investments that havent even been sold yet could help finance President Bidens now. Capital gains tax is a.

Secretary Janet Yellen has been discussing in various media the Biden administration is now revealing an unrealized capital gains tax from stocks and bonds. And let me explain what that means. Reuters January 19 2021.

Government coffers during a virtual conference hosted by The New York Times. Unrealized Capital Gains Tax In this presentation I will be discussing a proposal brought by Janet Yellen at the department of treasury and our current federal government.

Janet Yellen S Preposterous Tax Plan Stock Investor

Practical Memes Key Points Taxing Unrealized Capital Gains Is Not Practical And Will Hurt Sentiment Among Investors Said Howard Marks Co Chairman And Co Founder Of Oaktree Capital Unrealized Capital Gains

Janet Yellen It S Not A Wealth Tax It S A Tax On Unrealized Capital Gains Bit Haw

Does Treasury Secretary Yellen Really Want Unrealized Capital Gains To Be Treated As Income Swfi

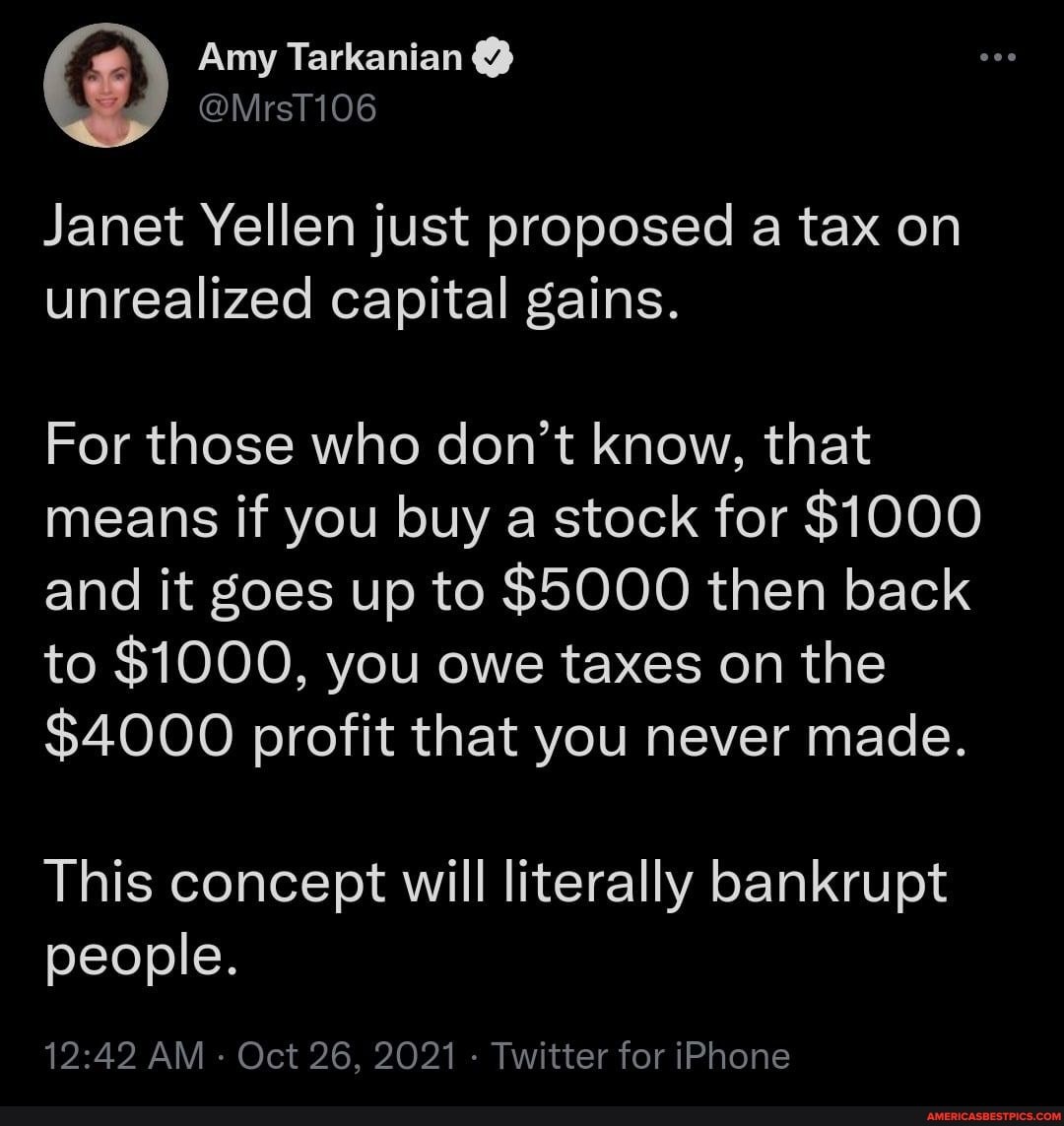

Lesson Of The Day Amy Tarkanian Janet Yellen Just Proposed A Tax On Unrealized Capital Gains

Biden S Cabinet Janet Yellen Considers Taxing Unrealized Gains R Accounting

Lorde Edge And Unrealized Gains Tax No Safe Bets

Janet Yellen Favors Higher Company Tax Signals Capital Gains Worth A Look Business Standard News

Janet Yellen Proposes Insane Capital Gains Tax On Bitcoin Youtube

Janet Yellen S Preposterous Tax Plan Stock Investor

Best Argument Against Unrealized Capital Gains Tax Janet Yellen Capital Gains Tax Youtube

Taxing Unrealized Capital Gains A Truly Bad Idea The Musings Of The Big Red Car

Janet Yellen Just Proposed A Tax On Unrealized Capital Gains For Those Who Don T Know

Janet Yellen Unveils Proposal To Tax Unrealized Dreams

Democrats Terrible Idea Taxing Profits That Don T Exist

Us Lawmakers Float Tax On Billionaires Unrealised Capital Gains The Market Herald

Bloombergquint On Twitter Yes Taxation Of Unrealised Stock Market Gains Seems Unusual But It Is Already Embedded In The System Argues Shankkaraiyar Calling For A One Time Tax On Billionaires He Points To

Treasury Secretary Janet Yellen Says Taxing Unrealized Capital Gains Is A Possibility Youtube

Why The Fed Needs Janet Yellen To Steal W Unrealized Capital Gains Avoiding Taxes W Roth Iras Youtube